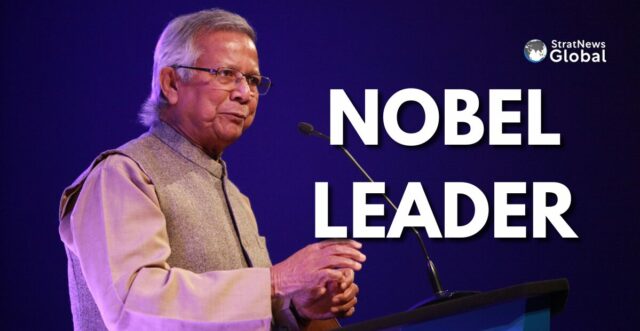

Nobel laureate Muhammad Yunus, a pioneer of the global microcredit movement, is poised to become the chief adviser of Bangladesh’s new interim government. Yunus has been an arch-foe of Prime Minister Sheikh Hasina, who recently resigned and fled the country.

Yunus And The Microcredit Revolution

Muhammad Yunus, known as the “banker to the poor,” founded the Grameen Bank, which won the 2006 Nobel Peace Prize. The bank helped lift millions out of poverty by providing small loans, often less than $100, to the rural poor who were too impoverished to attract traditional banks’ attention. This innovative lending model has inspired similar projects worldwide, including Grameen America, a non-profit Yunus started in the United States.

Political Tensions With Sheikh Hasina

As Yunus’ success grew, he briefly flirted with a political career in 2007, attempting to form his own party. This move reportedly sparked the ire of Hasina, who accused him of “sucking blood from the poor.” Critics in Bangladesh and other countries, including India, have claimed that microlenders charge excessive rates and profit from the poor. Yunus defended the interest rates, arguing they were much lower than local rates or the 300% or more demanded by loan sharks.

Removal and Legal Battles

In 2011, Hasina’s government removed Yunus as head of Grameen Bank, citing his age as he had surpassed the legal retirement age of 60. This decision led to widespread protests, with thousands of Bangladeshis forming a human chain in support of Yunus.

Yunus has faced numerous legal challenges, including a six-month prison sentence in January for labour law violations and charges of embezzlement of 252.2 million taka ($2 million) from a telecom company’s workers’ welfare fund. He denies these accusations, calling them “very flimsy, made-up stories.”

Yunus’ Criticism of Hasina’s Government

Yunus has been a vocal critic of Hasina’s administration, accusing it of monopolising power. “Bangladesh doesn’t have any politics left,” he said in June. “There’s only one party which is active and occupies everything, does everything, gets to the elections in their way.”

On Monday, Yunus referred to Hasina’s exit as the “second liberation day” for Bangladesh, likening it to the country’s 1971 war of independence from Pakistan.

Agreement To Lead Interim Government

Currently in Paris for a minor medical procedure, Yunus has agreed to a request from student leaders, who led the campaign against Hasina, to be the chief adviser of the interim government. Yunus was an economist at the University of Chittagong when famine struck Bangladesh in 1974. The experience motivated him to find better ways to support the rural poor.

The Genesis Of Grameen Bank

Yunus’ journey into microcredit began when he encountered a woman in a village near the university who borrowed from a moneylender. She had taken less than a dollar but was forced to sell her products to the lender at prices he set. Seeing this as a form of “slave labour,” Yunus lent funds to 42 people who had borrowed a combined $27 from the moneylender. The success of this initiative led him to view credit as a basic human right.

“When I gave the loans, I was astounded by the results. The poor paid the loans on time every time,” Yunus said in his Nobel acceptance speech.

(With Inputs from Reuters)

Research Associate at StratNewsGlobal, A keen observer of #China and Foreign Affairs. Writer, Weibo Trends, Analyst.

Twitter: @resham_sng