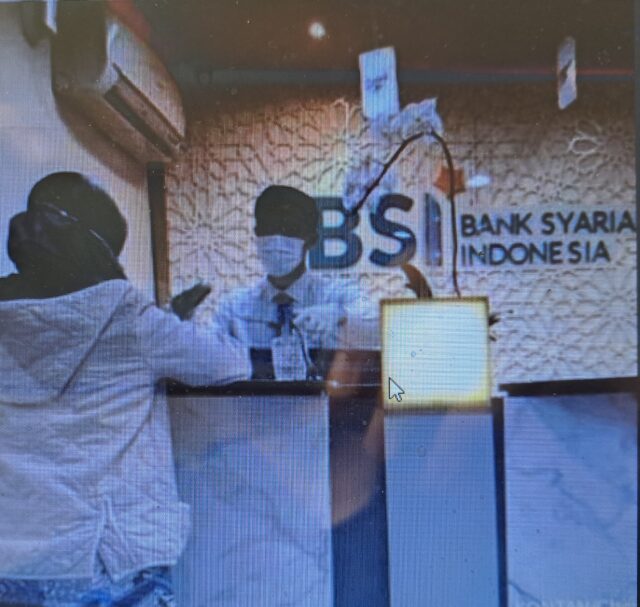

Indonesia’s biggest bank Bank Syariah Indonesia (BRI) is having a problem. Customers are being defrauded of their savings digitally. Hackers are taking money from the bank digitally reducing bank balances to zero. This is part of a larger problem. According to an Al Jazeera report, attacks on email accounts in Indonesia rose by 85 percent in the third quarter of 2023, even as breaches in countries such as the US and Russia declined, according to data collected by Netherlands-based cybersecurity firm Surfshark. Government banks are the largest target as they are the most vulnerable.

“Banks are targets because banks are where the money is,” BRI’s head of information Muharto, who like many Indonesians goes by only one name, said at a forum in Jakarta in June. According to a Reuters report the bank also had account details of 15 million customers were published online. The data breach, which one cybersecurity expert said was the country’s worst at a financial institution, is the latest in a series of leaks at Indonesian companies and government agencies in the past few years.

As Southeast Asia’s largest economy, with the fourth-highest number of internet users and the fifth-largest e-commerce sector in the world, Indonesia is an attractive target for cybercriminals. Lack of awareness for cybersecurity by customers, usage of bank apps which are not security and the cutting off funds to the National Cyber and Encryption Agency from 2 trillion [rupiahs] in 2019 to 100 billion [rupiahs] during the pandemic made cyber crimes easier and more attractive. Balinese law firm Malekat Hukum have promised some customers that it will represent them pro-bono and that they should take the bank to court.

Cyber experts in the country have said the problem is not limited to BRI and that the problem is likely to get worse before it gets better because cybersecurity is still not being taken seriously. That they warn could trigger a banking collapse if left unchecked.