Support us by contributing to StratNewsGlobal on the following UPI ID

ultramodern@hdfcbank

Strategic affairs is our game, South Asia and beyond our playground. Put together by an experienced team led by Nitin A. Gokhale. Our focus is on strategic affairs, foreign policy and international relations, with higher quality reportage, analysis and commentary with new tie-ups across the South Asian region.

You can support our endeavours. Visit us at www.stratnewsglobal.com and follow us on YouTube, Twitter, Facebook and Instagram.

र 500 per month

र 1000 per month

र 5000 per year

र 10000 per year

Donate an amount of your choice

र 500 per month

Donate र 500 per month

Donate र 1000 per month

Donate र 5,000 per year

Donate र 10,000 per year

![]()

Donate an amount of your choice

Donate an amount of your choice

G20 Summit: US Boycott Undermines Group, Warns South Africa’s Envoy

South Africa, current G20 president, is hopeful of a “substantial outcome” at the summit in Johannesburg over the weekend despite the US decision to not attend.

Describing the US move as unfortunate, Anil Sooklal, South Africa’s high commissioner to India, told StratNewsGlobal that it undermines the very ethos on which the multilateral grouping was formed post the 2008 financial crisis.

“The G20 is about being inclusive and decisions are made on the basis of consensus,” he said adding that “I think the irony of this position is that when you had the financial crisis of 2008 and when the G20 was elevated to the status of a summit level meeting, and the first summit was convened by the USA in Washington, so Washington played a pivotal role in bringing us all together.”

The US move was one among other challenges that the G20 had to face, Sooklal recalled.

“The past four summits, which have been presided over by countries of the Global South, have been the most challenging for a number of reasons. Firstly, when Indonesia inherited the presidency, we were just coming out of Covid. And, Covid was a major factor in terms of the impact it had, not just on the financial and economic architecture, but on various dimensions of our development trajectory as developing countries.”

Specifically about South Africa, Sooklal pointed to the Russia-Ukraine war, the Israel-Gaza conflict and a United States that has “weaponized trade through tariffs.”

“South Africa has to deal with all of these. But I think what we have demonstrated as countries of the Global South that even though we steered the G20 at its most difficult period, we were able to find consensus and have substantive outcomes as countries of the Global South, demonstrating our ability to lead and to deal with complex issues in an inclusive manner,” he said adding that Pretoria is facing “multi-layered challenges”.

As the Global North and South, there is a need to work in an inclusive manner, to find a solution to a very challenging situation that we experienced, that impacted, not just on the Global North, which was the epi-centre of the financial crisis, but the impact it had on the world as a whole.”

Doval Meets Bangladesh NSA Ahead Of Regional Security Dialogue

National Security Adviser Ajit Doval met his Bangladeshi counterpart Khalilur Rahman in New Delhi on Wednesday, ahead of the Seventh NSA-level Meeting of the Colombo Security Conclave (CSC) in New Delhi on November 20.

The Bangladesh High Commission said the two advisers reviewed the CSC’s ongoing work and exchanged views on bilateral matters, with Rahman also inviting Doval to visit Bangladesh at a suitable time.

Although presented as a routine preparatory discussion, the meeting carries unusual diplomatic weight since he is only the second senior Bangladeshi official to visit India since the ouster of former Prime Minister Sheikh Hasina, who fled to India in August 2024. Hasina was sentenced to death by Bangladesh’s International Crimes Tribunal a day before Rahman’s Delhi visit. Dhaka has formally asked India to extradite her, an issue that now shadows any high-level engagement. New Delhi has said it has noted the verdict and reiterated its commitment to the “best interests of the people of Bangladesh”.

These tensions place added significance on the CSC summit, which begins on November 20. NSA Doval is hosting his counterparts from Sri Lanka, Maldives, Mauritius and Bangladesh, with Seychelles participating as an observer and Malaysia joining as a special guest. This marks the first high-level CSC gathering since the bloc’s foundational documents were signed in Sri Lanka last year, an important step in institutionalising security cooperation across the Indian Ocean region.

The meeting will review progress across five core CSC pillars: maritime security; counterterrorism and anti-radicalisation; transnational crime; cybersecurity and critical infrastructure protection; and humanitarian assistance and disaster relief. Member states are expected to finalise the 2026 Roadmap and Action Plan, with discussions covering maritime domain awareness, shared cyber defences for ports and power grids, and coordinated responses to trafficking networks and extremist threats. India is also likely to call for more frequent joint exercises and operational-level cooperation among member and partner countries.

Rahman’s participation has drawn particular attention because this is his first official visit to India since becoming Bangladesh’s NSA in April 2025. He arrives as Bangladesh navigates a turbulent political transition under the interim government led by Chief Adviser Muhammad Yunus, which has announced that national elections and a referendum on the 2024 reform charter will be held together in February 2026. Rahman has become a central diplomatic figure for the interim administration, engaging with partners including the United States, China and Qatar, and playing a key role in regional humanitarian discussions related to Myanmar’s Rakhine State.

Against this backdrop, his visit to Delhi serves dual purposes: representing Bangladesh in a key regional security forum, and quietly maintaining diplomatic continuity with India at a time when bilateral sensitivities are high. Any exchanges on the sidelines—whether addressing contentious issues or simply reinforcing communication channels—are likely to be closely watched in both capitals and across the region.

The New Delhi CSC meeting ultimately aims to reinforce the Indian Ocean region’s collective security architecture at a moment of heightened geopolitical attention.

Trump Grants Saudi Arabia Major Ally Status

The United States has formally designated Saudi Arabia a Major Non-NATO Ally (MNNA), a significant upgrade in bilateral defence ties announced by President Donald Trump during Crown Prince Mohammed bin Salman’s visit to the White House on November 18.

Trump unveiled the designation at a dinner in honour of the Crown Prince. The MNNA status grants Riyadh a suite of defence-trade privileges. These include the sale of 48 F-35 jets, streamlined access to U.S. military technology, eligibility for joint research and development with the Pentagon, and the potential stationing of U.S. war-reserve materiel on Saudi soil. The two countries also signed a joint declaration on the completion of negotiations on civil nuclear energy cooperation.

The approval to sell the F-35 stealth fighter jets to Saudi Arabia is a major shift given earlier American reluctance to provide the platform to Gulf states. The Jerusalem Post said the deal could alter the military balance in the Middle East and test Washington’s definition of maintaining what the US has termed Israel’s “qualitative military edge”. Until now, Israel has been the only country in the Middle East to have the F-35.

This pact comes despite an earlier U.S. Defense Intelligence Agency report warning that China could acquire the F-35’s advanced technology given Beijing’s defence ties with Riyadh. China is now Saudi Arabia’s largest trading partner, and the two have also conducted several joint naval exercises in recent years.

Al Jazeera said a White House fact sheet confirmed the F-35 transfer and added that Riyadh would also buy around 300 U.S.-made tanks as part of a broader military package that extends to artificial intelligence cooperation, nuclear-energy collaboration and supply-chain integration on critical minerals. Al Jazeera also said the U.S. described the agreement as strengthening deterrence across the Middle East while reducing costs for Washington by securing new Saudi “burden-sharing” contributions.

Politico reported that Crown Prince Mohammed used the visit to signal a dramatic expansion in Saudi investment in the United States, pledging to raise it from roughly $600 billion to nearly $1 trillion. The outlet framed the pledge as part of a broader reset in U.S.–Saudi ties under Trump, who has sought to lock in the kingdom as a central pillar of his Middle East strategy.

Some reports said the designation is primarily a political and practical signal of strategic closeness: it does not create a mutual-defence guarantee or any automatic U.S. military obligation.

The National explained that the benefits of MNNA status are substantial but finite. U.S. officials quoted by the outlet stressed that MNNA “does not entail any security commitments.” Rather, it offers a formalised pathway for closer defence cooperation, expedition of military sales, and a more predictable framework for long-term technological and industrial collaboration.

ABC News reported that President Donald Trump defended Saudi Crown Prince Mohammed bin Salman during the royal’s first U.S. trip in seven years, calling his human-rights record “incredible” and dismissing questions about Jamal Khashoggi’s murder.

ABC News' Chief White House Correspondent Mary Bruce asked Pres. Trump and Saudi Crown Prince Mohammed bin Salman about journalist Jamal Khashoggi's murder and the anger 9/11 families have expressed over the visit because of Saudi Arabia's alleged role. https://t.co/7fVh09CzQI pic.twitter.com/dukVdO8xI7

— ABC News (@ABC) November 19, 2025

ABC noted that U.S. intelligence has assessed that the Crown Prince approved the operation that killed the Washington Post columnist, but Trump said, “Things happen… he knew nothing about it, and we can leave it at that.”

Trump’s announcement also arrives against a wider regional backdrop. In September 2025, Saudi Arabia signed a mutual-defence pact with Pakistan, which the press coverage cited as part of a shifting Gulf and South Asian strategic landscape.

Earlier high-level U.S. meetings with Pakistan’s military leadership indicate renewed Washington interest in Islamabad’s regional role. These developments form part of the environment in which the Saudi MNNA designation was made, though the U.S.-Saudi agreement stands on its own.

Former Indian foreign secretary Kanwal Sibal, commenting on X, linked the U.S.–Saudi agreement, the Saudi–Pakistan defence pact and recent American outreach to Pakistan.

The “US has now signed a strategic defence agreement with Saudi Arabia. Separately, Pakistan and Saudis have signed a defence pact. Rubio has said the US is exploring a stronger strategic partnership with Pakistan. These are coordinated moves,” he said.

“This explains Trump’s lionising of Asim Munir and his attempt to meddle in India-Pak relations in Pakistan’s favour. The objective seems to be to protect Pakistan’s flank with India as much as possible so that it can play its designated regional role.”

This development indicates a substantial but carefully bounded upgrade in U.S.–Saudi defence relations. The MNNA designation offers Saudi Arabia privileged access to American military systems, defence-industrial opportunities and strategic coordination, while allowing the U.S. to deepen ties with a key Gulf partner without committing to treaty-level obligations.

The upgrade also comes amid continuing scrutiny of Trump’s personal financial ties to Saudi Arabia. Forbes reported on November 14 that “the president and his family struck at least nine deals with Saudi investors, pushing millions into the president’s golf properties,” documenting a pattern of Saudi-linked investment flowing into Trump-owned assets over several years.

Forbes detailed these business relationships as part of a broader examination of financial intersections between Trump and Saudi entities. The reporting did not link these investments directly to the MNNA decision but situates the announcement against a backdrop of long-standing financial entanglements.

The State Department said Saudi Arabia will become the 20th nation to be granted MNNA status, which is viewed as a powerful symbol of the strength of the relationship between the US and a foreign partner.

According to the New York Post, Argentina, Australia, Bahrain, Brazil, Colombia, Egypt, Israel, Japan, Jordan, Kenya, Kuwait, Morocco, New Zealand, Pakistan, the Philippines, Qatar, South Korea, Thailand and Tunisia have previously been granted MNNA status. Taiwan too is treated as a major non-NATO Ally although it does not formally hold the title.

Poland To Shut Russian Consulate After Railway Explosion

Poland said on Wednesday it would close the last Russian consulate in its territory and urged EU allies to restrict Russian diplomats in the bloc’s Schengen free-travel area in response to a railway explosion it blames on Moscow.

Poland, a major ally in Kyiv’s fight against Russia’s invasion, says two Ukrainians collaborating with Moscow perpetrated the weekend blast on the Warsaw-Lublin line, which connects Warsaw to the Ukrainian border.

The pair fled to Belarus, an ally of Russia, Warsaw says.

‘Russophobia’

Polish Foreign Minister Radoslaw Sikorski said at a news conference that the first response would be to close the last operating Russian consulate in Poland in the northern city of Gdansk.

Poland has previously closed Russian consulates in Krakow and Poznan over sabotage acts.

“It was not only an act of sabotage but also an act of state terrorism,” Sikorski earlier told lawmakers of the railway attack, saying a non-diplomatic response would be coming too.

Moscow denies responsibility for sabotage, citing “Russophobia” in Poland, and said it would likewise limit Poland’s diplomatic and consular presence in Russia.

Warning To EU

Sikorski also told reporters he would ask other EU nations to limit Russian diplomats’ travel in the 25-nation Schengen area, warning “this is not the end” of Poland’s response.

“We encourage our allies in the European Union to prevent Russians from enjoying the benefits of the Schengen countries, which they are trying to destroy, among other things, by pushing migrants across the border,” Sikorski said.

Poland and its European Union allies accuse Minsk and Moscow of orchestrating a migrant crisis on its border with Belarus.

Jacek Dobrzynski, spokesperson for Poland’s minister in charge of intelligence services, said that in addition to the two suspects who had fled, several other people had been detained over the railway blast, but he did not give more details.

There has been a wave of arson, sabotage, and cyberattacks in Poland and other European nations since Russia’s full-scale invasion of Ukraine began in 2022.

(with inputs from Reuters)

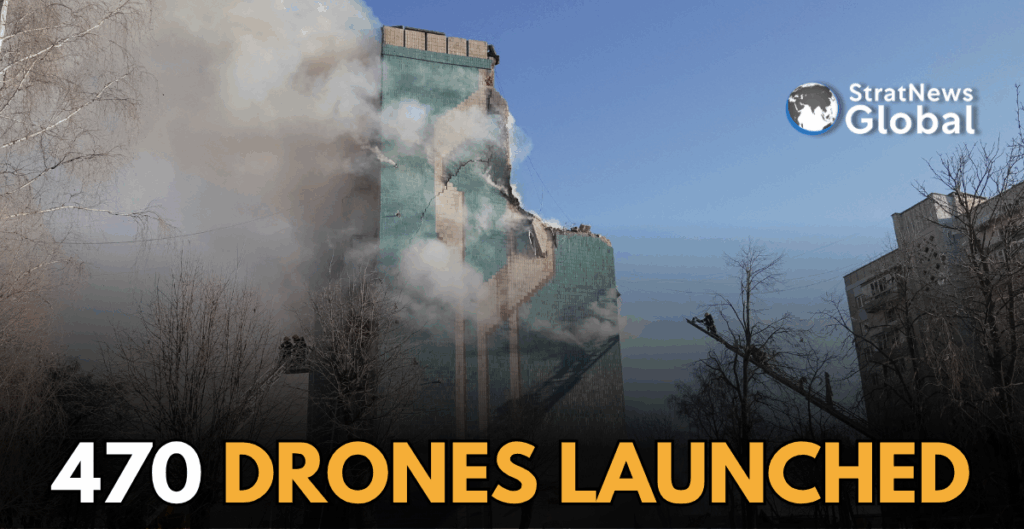

Russia Launches 470 Drones, 48 Missile On Ukraine, Kills 19

Nineteen people were killed in a heavy overnight attack of missiles and drones by Russia that struck an apartment building in the western city of Ternopil, officials in Ukraine said on Wednesday.

Another 66 people were wounded in the overnight strikes on Ukraine that targeted energy and transport infrastructure, forcing emergency power cuts in a number of regions in frigid temperatures.

The upper floors of the residential building in Ternopil were torn away in the attack. Black smoke poured upwards, while an orange glow burned through the haze from a fire in the tower block.

Russia launched more than 470 drones and 48 missiles on Ukraine in the overnight attack, officials said. Poland, a NATO member state bordering western Ukraine, temporarily closed Rzeszów and Lublin airports in the southeast of the country and scrambled Polish and allied aircraft as a precaution to safeguard its airspace.

More Pressure On Russia

President Volodymyr Zelenskiy, who was due to hold talks in Turkey in efforts to revive peace negotiations with Russia, confirmed multi-storey residential buildings had been hit in Ternopil, and said others may be trapped under the rubble.

He urged allies to increase pressure on Russia to end its nearly four-year-old war in Ukraine, including by providing Kyiv with more air-defence missiles.

“Every brazen attack against ordinary life shows that the pressure on Russia is insufficient. Effective sanctions and assistance to Ukraine can change this,” he said on X.

Energy officials said energy infrastructure had been struck in seven Ukrainian regions. A Reuters witness in the western city of Lviv reported hearing explosions, and Kyiv residents took cover in metro stations on Wednesday morning.

The full extent of the damage was not immediately clear, but restrictions were placed on power usage for consumers across the country.

(with inputs from Reuters)

Pakistan: PML-N’s 27th Amendment Ensure’s Army Backing, Strangles Judiciary

It’s been six months since Pakistan’s Army Chief Gen Asim Munir elevated himself to the rank of field marshal. Now, he’s got another promotion, to Chief of Defence Forces (CDF), and he has the civilian establishment to thank.

Suba Chandran, who teaches and researches on Pakistan at the National Institute of Advanced Studies in Bengaluru, says the 27th amendment which brought about Munir’s promotion, has other implications but it’s important to understand why the ruling PML(N) under Prime Minister Shehbaz Sharif came up with it.

“If you look at the number of the seats that PML-N has, all of them are from from Punjab, and the PTI (of Imran Khan) has given a tough fight in Punjab … So PML-N is pretty weak and getting weaker and the only base that it could look for (help) is the (army) establishment.”

Chandran said on The Gist that it was the army which helped the PML-N win the elections in February last year, defeating the PTI, and the party reasoning was if they need army backing in Punjab going forward, it might be worthwhile to give the uniforms something.

This was achieved through the medium of the 27th amendment. By elevating Asim Munir to CDF with a 5-year-term and life-long immunity from acts committed while in service, and getting it passed in parliament, thereby making it legal and overboard, the army has been won over.

But as Chandran notes, the PML-N also wanted to ensure the judiciary would not stand in the way in future.

“It is very important that the PML-N has a pliable judiciary in terms of the cases against Imran Khan and the PTI. So they have created the Federal Constitutional Court … the Supreme Court today is no more guardian of the Constitution because the Federal Constitutional Court will be the guardian.”

Tune in for more in this conversation with Suba Chandran of the National Institute of Advanced Studies in Bengaluru.

Dutch Government Suspends Nexperia Intervention Amid China Talks

The Dutch government announced on Wednesday that it is suspending its intervention at chipmaker Nexperia following what it described as constructive talks with China over a dispute that has caused chip shortages for car manufacturers.

While the decision may reassure customers that tensions between China and the Netherlands over Nexperia are easing, supply chain challenges remain unresolved.

Even the dispute between Nexperia’s European headquarters and its Chinese parent Wingtech remains which was sparked by the Dutch state taking control of Nexperia on September 30.

The Dutch government said the move was needed to prevent Nexperia’s former CEO from moving its operations to China. Beijing responded by halting exports of Nexperia’s finished products on October 4, a measure it has since partly relaxed.

Dutch Economy Minister Vincent Karremans said on Wednesday that suspending the government intervention represented a gesture of goodwill, adding that talks will continue.

Impact on Automotive Supply Chains

Nexperia is a major supplier of basic computer chips to the car industry, and shortages have threatened automotive supply chains, leading to production slow downs and halts.

The company manufactures most of its wafers in Hamburg, Germany, and then sends them to Dongguan, China to be packaged and sent on to customers.

Stalemate Continues to Threaten Supplies

After the Dutch state intervention, Nexperia’s Chinese arm declared itself no longer subject to control by European management and on Oct. 26, the European side of the company stopped shipping wafers to it, citing non-payment.

That stalemate continues to threaten supplies, although the Chinese side is now selling down stockpiles of chips it has previously processed, offering temporary relief to customers.

Spokespeople for Nexperia and Wingtech, which oversees the Chinese operations, both said they were preparing reactions to Wednesday’s move by the Dutch government.

Separately, a Dutch court in October ordered the removal of ex-Nexperia CEO and Wingtech founder Zhang Xuezheng, citing alleged mismanagement.

Wingtech has said it will fight the decision.

The next step in the legal process will be hearings on a formal investigation into mismanagement, a spokesperson for Amsterdam’s Enterprise Court said.

No date has been set.

(With inputs from Reuters)

EU To Ease Digital Rules, Watchdogs Warn Of Big Tech Sway

Europe is set to streamline its AI and privacy laws on Wednesday to simplify the EU’s tougher digital laws in a move critics say will appease Big Tech and U.S. President Donald Trump.

The European Commission’s plans include allowing tech firms to use personal data to train AI models based on legitimate interest without asking for consent, and delaying rules for high-risk AI systems by a year, a draft seen by Reuters shows.

EU antitrust chief Henna Virkkunen is due to present a ‘Digital Omnibus’ to cut red tape and overlapping laws such as the GDPR, the AI Act, the e-Privacy Directive, and the Data Act.

Ambitious Digital Laws

Over the last decade, the European Union (EU) has introduced ambitious digital laws ranging from the General Data Protection Regulation (GDPR) to the AI Act, which business groups say hamper innovation and leave European firms at a disadvantage.

Companies from Google owner Alphabet and Facebook owner Meta to Europe’s Siemens and SAP have all called for a revision of the AI rules to make things easier for business.

Meanwhile, the Trump administration has regularly criticised EU regulations and said it was targeting U.S. firms, charges which the Commission had rejected.

Tech lobby groups had also urged the EU to pause implementation of the AI Act, which entered into force last year with various provisions being phased in.

“The Commission needs to show it is serious about simplifying rules and fostering innovation, while safeguarding Europe’s legal heritage and landmark legislation,” Dessislava Savova, partner at law firm Clifford Chance, told Reuters.

“We don’t expect a regulatory revolution, but we do hope for meaningful, practical changes.”

More Predictable Rules

Changes to the AI Act include exempting companies from registering their AI systems in an EU database for high-risk systems if these are only used for narrow or procedural tasks.

“The Commission appears to be aiming for simpler, more predictable rules that reduce friction for innovators while keeping core EU safeguards intact,” Ahmed Baladi, partner at law firm Gibson Dunn, told Reuters.

The proposals would need to be approved by EU countries and privacy-focused members of the European Parliament before they can be implemented.

Lawmaker Brando Benifei, who led negotiations on AI rules, said on Tuesday that the European Parliament must continue defending European citizens’ digital rights.

‘Biggest Rollback Of Digital Assets’

Privacy activists such as Noyb and civil rights groups see the amendments as a dilution of EU regulations.

An open letter from a group of 127 civil organisations called the proposals “the biggest rollback of digital fundamental rights in EU history”.

And on Wednesday, a group of campaigners deployed four mobile billboards around Brussels, alongside hundreds of posters across the city, urging Commission President Ursula von der Leyen to stand up to Big Tech and the U.S. President.

“It is disappointing to see the European Commission cave under the pressure of the Trump administration and Big Tech lobbies,” Dutch MEP Kim van Sparrentak said in a statement.

(with inputs from Reuters)

Japan: Largest Ever Urban Fire Ravages Over 170 Buildings

A fire ripped through more than 170 buildings and killed one person in a southern coastal city called Oita in Japan on Wednesday, with military and firefighting helicopters scrambling to extinguish the country’s largest urban blaze in almost half a century.

Aerial footage from broadcasters showed houses reduced to rubble and thick plumes of smoke rising from the hilly Saganoseki district of Oita city, which overlooks a fishing harbour renowned for its premium Seki-brand mackerel.

The flames had also spread to nearby forested slopes and an uninhabited island more than one kilometre off the coast, likely due to strong winds, local media reported.

One Oita resident told the Japanese broadcaster NHK that the flames turned the city’s skies red. “The wind was strong. I never thought it would spread so much,” he said.

Cause Under Investigation

The blaze started on Tuesday evening and has burned 48,900 square metres – roughly the size of seven soccer fields – forcing 175 residents in the district, some 770 km (478 miles) southwest of Tokyo, to flee to an emergency shelter, Japan’s Fire and Disaster Management Agency said.

The cause of the fire was under investigation, the agency added.

One person has been found dead, local media reported, citing police sources, while a woman in her 50s was reported to be hospitalised for mild burns.

“I extend my heartfelt condolences to all residents who are evacuating in the cold,” Japanese Prime Minister Sanae Takaichi said in a post on X.

“The government will provide the maximum possible support in collaboration with local authorities,” she wrote.

Largest Urban Fire

The fire has caused power outages at around 300 houses in the district, according to Kyushu Electric Power 9508.T.

The number of buildings and size of the area engulfed in flames make it the largest urban fire in Japan since a 1976 blaze in Sakata, excluding incidents caused by earthquakes.

In 2016, a fire in Itoigawa burned 147 buildings and about 40,000 square metres. No one was killed.

(with inputs from Reuters)

Ukraine Pushes Europe For $163 Billion From Frozen Russian Assets

Ukraine is urging European partners to make a political decision next month to unlock a proposed $163 billion loan backed by frozen Russian state assets, as it confronts a major 2026 budget gap and the fallout from a growing corruption scandal.

European leaders failed to agree on the “Reparations Loan” for Kyiv last month and will discuss it again at a summit on December 18, with Ukraine expected to need its first big injections of financial support from the second quarter of 2026.

A senior official in President Volodymyr Zelenskyy’s administration told that the summit looked to be the last chance for Europe this year to agree to provide the loan for Ukraine, a move Russia said would elicit a “painful response”.

A Hole In Wartime Budget Looms

With little clear prospect of direct U.S. aid under President Donald Trump, Ukraine could run out of money during the first quarter of next year if new European assistance does not come through, economic analysts say.

EU leaders agreed last month to meet Ukraine’s “pressing financial needs” for the next two years but stopped short of endorsing a plan to use frozen Russian assets to fund a giant loan to Kyiv because of concerns raised by Belgium.

On Monday, European Commission President Ursula von der Leyen told European governments in a letter that there were three options to finance Ukraine and that a combination of them was also possible.

Apart from the loan, the options include European Union countries providing grants and the bloc borrowing on markets.

The document estimated that Ukraine’s remaining needs for 2026-2027 amounted to 135.7 billion euros ($157.37 billion).

The Commission’s proposal to use frozen Russian assets would produce a loan of 140 billion euros, covering those needs.

(With inputs from Reuters)