Shortly after President Donald Trump imposed a 25% tariff on Indian goods, Washington inked a trade deal with Islamabad that trims US tariffs on Pakistani exports to 19% and, though not yet confirmed, is expected to grant zero tariffs for US goods entering Pakistan.

The move gives Pakistan only a narrow commercial gain, mostly in textiles, but a far bigger diplomatic prize — positioning itself as a more cooperative partner for Trump’s transactional White House than India at this moment. The deal was sweetened by Trump’s pledge to work with Pakistan in developing its oil reserves, adding a strategic energy layer to the emerging alignment.

Economic Impact

In 2024, total US–Pakistan trade hit around $7.2 billion. The US remained Pakistan’s biggest export destination, contributing to a $3.33 billion trade surplus, though Pakistan accounted for just 0.1% of total US imports and ranked 56th among US trading partners.

The new 19% rate replaces a previously floated 29%, announced around Liberation Day. In exchange, Pakistan committed to boosting imports from the US, especially cotton and soybeans, along with others.

Textiles dominate Pakistan’s exports to the US, about 77% by volume, worth $4.18 billion. That means even with better tariff terms, Pakistan’s narrow export base limits how much it can benefit from the deal. There’s minimal diversification, and other industries lack strong, resilient supply chains.

Global Trade Alert data shows Vietnam enjoys an average of 5.4% tariff advantage compared to its peers under Trump’s tariffs, more competitive than Pakistan’s 3.3% edge. Of 1,951 product lines of Pakistan’s exports, 1306 could be advantaged. Out of it, the majority is apparel, made-up textiles, and cotton fabrics, which may see access gains in the US market; however, Vietnam remains a stronger competitor in this sector.

Pakistan’s export woes, including low productivity, weak innovation, complex incentives, limited new markets, and low R&D, are real and persistent barriers which limit its export interests despite the tariff arbitrage.

Without strategic export diversification, Pakistan’s exports, heavily reliant on textiles and concentrated on the US, are risky, especially under Trump’s administration.

The second aspect of the deal entails that the US will help Pakistan develop domestic oil reserves. Currently, oil makes up nearly 20% of Pakistan’s import bill. Proven recoverable reserves are around 234–353 million barrels, placing Pakistan roughly 50th globally and comprising just 0.021% of global oil reserves.

Even if the US worked with Pakistan to develop its oil reserves, at the current rate of consumption, this would only last under two years if Pakistan ceases oil imports. Also, even to assume that the reserves will be developed, oil exploration takes years and massive capital.

Even partnering with the US, risks remain due to the unpredictability of Trump’s policies – Nobody knows anything. That unpredictability itself will be the biggest hurdle to investment in Pakistan’s energy sector.

Strategic Implications

From a strategic viewpoint, the stated tariffs on Pakistani exports to the US invigorated discourse of potential reset in US-Pakistan ties. However, terming this as a reset may be overplayed and premature. What it does signify is an attempt to diversify the traditionally security-centric relationship to strategic economic collaboration.

The Pakistani finance ministry described the developments as the “beginning of a new era” in economic cooperation listing mining, energy, cryptocurrency, and rare minerals. That said, details surrounding Pakistan’s institutional capacity, infrastructure, and regulatory stability to capitalise on these endeavours remain obscure at present.

While critical mineral resources are known to exist, especially in Balochistan and northern regions of Pakistan, the volatility of these militant-infested areas will keep security-related concerns at the forefront. As a result, the process of exploration and extraction is expected to remain protracted.

The delays and stalling of the Beijing-funded China-Pakistan Economic Corridor (CPEC), predominantly due to security factors, exemplify these difficulties.

Pakistan has reportedly instituted regulatory bodies like the Pakistan Crypto Council in March 2025 under the Virtual Assets Act, 2025, and signed an MoU with US crypto platforms, including one linked to US President Trump’s business interests.

Nonetheless, the scarcity of a robust legal and technological framework, stability in energy production to build crypto infrastructure and overall political uncertainties in Pakistan will pose predictable hurdles to such aspirations. Notably, cryptocurrencies are yet to be fully legalised in Pakistan for public use.

Therefore, this diversification can be described as recalibration driven by Trump’s transactional nature of diplomacy. These benefits come with strings attached.

Pakistan is still perceived by the US through a security prism – a counter-terrorism partner and a geo-strategically positioned country bordering Afghanistan and Iran.

Pakistan’s assistance in arresting the Islamic State Khorasan Province mastermind, responsible for the 2021 Abbey Gate bombing in Kabul, near the Afghanistan-Pakistan border in Balochistan earlier in February, resuscitated its utility in the US security calculus.

The purported collaboration of ISI-CIA for this operation and US CENTCOM chief’s acknowledgement of Pakistan as a “phenomenal partner” in counter-terrorism further ascertains this functional reliance.

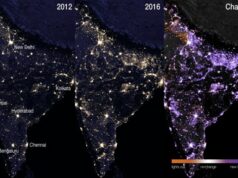

Geopolitically, the timing of the tariff announcement gains high notability for its occurrence a day after the US imposed 25% tariffs on Indian imports citing its continued oil trade with Russia. This development raised inevitable concerns and contentment, depending on what capital you are in: Is the US signalling grievances with New Delhi or is it using Pakistan to gesture de-hyphenation?

While Islamabad can take this as a diplomatic victory, it would be too soon to regard this moment as a broader realignment. Despite Trump’s strong rhetoric against India-Russia oil trade, the US’s strategic bet remains on India as a significant counterweight to China in the Indo-Pacific region.

India’s economic capacity and integration with the QUAD make it indispensable to the US in present times.

Trump’s current rhetoric towards India may be informed by frustration over New Delhi’s repeated denial of US-brokered mediation between India and Pakistan, a sharp contrast to Pakistan’s public acknowledgement and praise of Washington’s role. In the current context, Islamabad remains a more cooperative partner for the transactional US administration.

The authors are Research Analysts with the Takshashila Institution