India as part of an international semiconductor alliance? It’s an idea whose time may have come.

Witness two recent developments: Last week (Sept 4-5) during Prime Minister Modi’s visit to Singapore, paragraph 2 of the joint statement referred to him and his host counterpart Lawrence Wong visiting AEM, “a leading Singaporean company in semiconductor and electronics sector.”

Paragraph 5 under Advanced Manufacturing had a little more:

“Both prime ministers agreed that advanced manufacturing, particularly in developing resilient semiconductor supply chains, can be a new pillar of bilateral cooperation. Both prime ministers welcomed the signing of the MoU on Semiconductor Partnership.”

The other development came four days later when the US State Department issued a press note saying it will work with India’s Semiconductor Mission and the Ministry of Electronics and IT, “to explore opportunities to grow and diversify the global semiconductor ecosystem under the International Technological Security and Innovation Fund (ITSI).”

Flowing from this, there will be a “comprehensive assessment” of India’s existing semiconductor ecosystem, regulatory framework as well as workforce and infra needs. This assessment when completed will lay the ground for “potential future joint initiatives to strengthen and grow in this critical sector”.

The ITSI Fund will have $500 million to spend (until 2028) with partners on securing the semiconductor supply chain, ensure trusted telecom technologies and other initiatives.

Industry sources told Stratnewsglobal that both developments were linked.

Singapore is the world’s fifth largest exporter of semiconductor devices, selling more than $7 billion in 2022. It is also host to several large fabrication plants including TSMC and US Microelectronic Corp among others.

The US, for it’s part, has been on a drive for some years to diversify away from China, the trade in critical technologies that includes semiconductors. It is looking at new markets where a large semiconductor ecosystem can grow, which means it must have scale, whether in terms of domestic demand, trained engineers, government backing and so on.

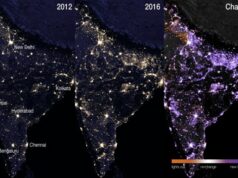

India fits this bill. A Business Today report of July 2023, noted that this country has 1,25,000 engineers currently working on various aspects of chip design and development. Add to that around 600,000 students opting for undergraduate degrees in electronics every year.

They could fill the emerging gap of 67,000 workers including technicians, computer scientists and engineers by 2030, in the US market alone. Worldwide, the semiconductor market will need to add 100,000 workers annually.

The Indian government is also stepping up its outreach to this sector. The other day some reports suggested government outlays for semiconductors could jump to $15 billion from the current $10 billion. The focus also appears to be shifting from ATMP (Assembly, Testing, Marking & Packaging) to fabs, tools and equipment, chemicals, gases and raw materials used in chipmaking.

In other words, the entire value chain from materials to wafers will be brought to India and the US appears ready to facilitate it.

Can India do it? The speed with which India has moved on semiconductors from virtually scratch, over the last two years, suggests this government is serious.

There may be some questions about the US role, given its determination to dominate the semiconductor chain and leave little if no room for China. Does it mean India’s total dependence on the US? How much room for manoeuvre will Delhi have? How much of the technology in this sector will be Indian?

One can speculate but the priority for now, is to build the semiconductor ecosystem in India and become part of the global supply chain.