Top Chinese banks are reportedly in talks to assist China Vanke, one of the country’s largest property developers, after its credit rating was downgraded to “junk” status by Moody’s. This downgrade reflects broader concerns about the health of China’s real estate industry, which has been grappling with declining sales and tightening credit conditions.

The situation has raised fears of potential defaults and liquidations, following the high-profile cases of Evergrande and Country Garden.

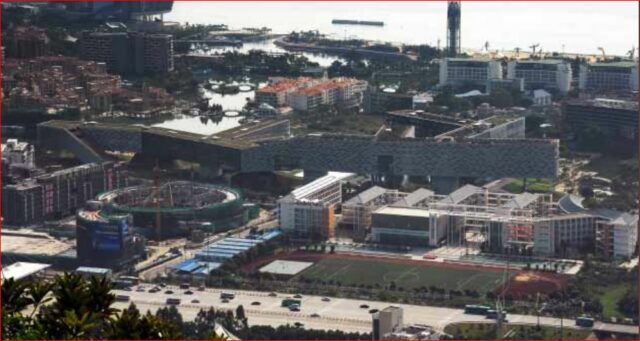

Founded 40 years ago, China Vanke has long been considered a bellwether of the Chinese property market. It was the country’s second-largest developer by sales last year. However, like many others in the industry, Vanke has been adversely affected by a slowdown in demand for apartments and a decline in home prices. These challenges have been exacerbated by the COVID-19 pandemic and government measures to cool speculative investment in the property market.

Amidst these challenges, Beijing is working to restore confidence in the sector and prevent further instability. The reported syndicated loan discussions involving major banks, including state-owned lenders, underscore the government’s efforts to stabilize Vanke’s financial position. However, uncertainties persist regarding the outcome of these negotiations and the company’s ability to meet its repayment obligations.

“Founded in 1984 in Shenzhen, Vanke is a flagship company in China’s property sector. Its founder Wang Shi is considered the “Godfather” of the industry and was likened to Donald Trump by Time magazine. It was the first listed property company in mainland China, boasting a high-profile IPO in 1991 on the still-nascent Shenzhen Stock Exchange,” reported CNN.

The news of potential financial support temporarily boosted Vanke’s stock prices, highlighting investors’ concerns about the company’s financial stability. Despite this, Vanke continues to face significant headwinds, including declining sales and deteriorating credit metrics.

The broader context of China’s real estate crisis underscores the urgency of addressing systemic issues within the industry. While government stimulus measures and liquidity injections aim to alleviate immediate pressures, regulators emphasize the need for a cautious approach. They have warned that troubled developers may face bankruptcy or restructuring, signaling a shift towards a more market-oriented approach to industry support.

Overall, the situation surrounding China Vanke reflects the broader challenges facing the country’s real estate sector and the government’s efforts to address systemic risks while balancing economic stability. The outcome of Vanke’s negotiations with banks will be closely watched as a barometer of sentiment in China’s property market and its implications for the broader economy.

Also See:

In a career spanning three decades and counting, Ramananda (Ram to his friends) has been the foreign editor of The Telegraph, Outlook Magazine and the New Indian Express. He helped set up rediff.com’s editorial operations in San Jose and New York, helmed sify.com, and was the founder editor of India.com.

His work has featured in national and international publications like the Al Jazeera Centre for Studies, Global Times and Ashahi Shimbun. But his one constant over all these years, he says, has been the attempt to understand rising India’s place in the world.

He can rustle up a mean salad, his oil-less pepper chicken is to die for, and all it takes is some beer and rhythm and blues to rock his soul.

Talk to him about foreign and strategic affairs, media, South Asia, China, and of course India.